Come visit Team Woodall’s booth at the 2nd Annual Oro Valley Expo on Friday, October 25th & Saturday, October 26th. We’ll be providing updates on the local housing market, passing out brochures of listings, and continuing to develop a rapport with our neighbors within the Oro Valley community. The event also features other local vendors from around Oro Valley & the Northwest Tucson area that will be surely worth your time to visit. Not only that but there will be events for the whole family to enjoy with “trunk or treating” on Friday and a “pumpkin patch” on Saturday. Hours for the event on Friday are from 3:00pm to 8:00pm and Saturday from 10:00am to 3:00pm. The location for this expo is at Casas Christian Church at 10801 N. La Cholla Boulevard. Look for our Team Woodall canopy tent outside and come by to say hi!

Come visit Team Woodall’s booth at the 2nd Annual Oro Valley Expo on Friday, October 25th & Saturday, October 26th. We’ll be providing updates on the local housing market, passing out brochures of listings, and continuing to develop a rapport with our neighbors within the Oro Valley community. The event also features other local vendors from around Oro Valley & the Northwest Tucson area that will be surely worth your time to visit. Not only that but there will be events for the whole family to enjoy with “trunk or treating” on Friday and a “pumpkin patch” on Saturday. Hours for the event on Friday are from 3:00pm to 8:00pm and Saturday from 10:00am to 3:00pm. The location for this expo is at Casas Christian Church at 10801 N. La Cholla Boulevard. Look for our Team Woodall canopy tent outside and come by to say hi!

|

|

|||||

|

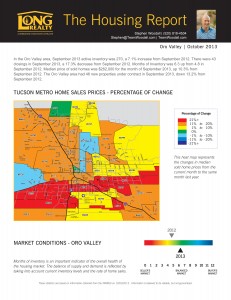

Enjoy these new Housing Reports and let us know your feedback on the new layout. This upcoming weekend the extremely popular Sothern Arizona Home Builders Association (SAHBA) Home & Garden Show returns to town. Starting on Friday, October 18th and continuing through the weekend, this event provides homeowners an excellent opportunity to get educated & shop. Exhibiting are a huge variety of vendors from builders, pool companies, landscape companies, to home product devices like shades, water filtration, tools, and many, many more. The event is being held again at the Tucson Convention Center located at 260 South Church Avenue. Hours for the show are Friday & Saturday from 10:00am – 7:00pm and Sunday from 10:00am – 5:00pm. More details and a list of exhibitors can be found at their website: http://sahbahomeshow.com or you can call (520) 795-3025 for more information. Parking is free for this event at TCC. Team Woodall does have a few coupons for discounted admission available to the first people that want to take advantage of them. Contact us at (520) 818-4504 to check on availability of the coupons. Make no doubt about it, the guidelines, or more accurately lack thereof, for mortgage qualifications during the housing “boom” was a major contributor to the economic recession we’re still climbing out of today. However, immediately afterwards the overcautious reaction was to create extremely stringent guidelines that ,ept many capable buyers from being able to qualify for loans. Over time we’ve begun to see these restrictions loosen a little bit at a time. Now it seems this trend is continuing, albeit maybe for the wrong reasons. With the rise in interest rates during the past couple months (rates have been heading downwards most recently) lenders began seeing fewer loan applications come in. This was a combination of buyers becoming hesitant to make a purchase with higher rates, although they’ve still maintained excellent affordability from a historical standpoint, and refinancing tapering off considerably since those who could have refinanced mostly already did with the previous lower rates. One way for lenders to increase the number of loans they’re originating then is to open up the pool of buyers more by relaxing guidelines. Normally this motive would be a cautionary tale, but the overly strict guidelines in place could use some relaxing on a case by case basis. A specific example of these loosened guidelines is that several local lenders are now able to offer FHA financing to people with credit scores as low as 620 rather than the 650 previously used as a benchmark. Not all buyers with a 620 will still qualify as the scores are only a small portion of the larger qualification picture and many lenders are examining the scores themselves to select buyers with a less risky reasoning for the lower scores. Past missed payments for instance would weigh more negatively on a buyer than a younger buyer just beginning to establish credit. It’s great to see guidelines becoming more situational to determine if a specific person is a worthy borrower with acceptable risk. No one should want to see a return of loose standards, but opening loans up to legitimately qualified purchasers will continue to help the economic recovery. The Town of Oro Valley has implemented a number of programs designed to promote local businesses and also help keep residents’ shopping dollars in town. One of these programs is Oro Valley Dollars. The OV Dollars are essentially gift cards that can be used at over 70 Oro Valley businesses rather than a typical gift card that can only be used at the one retail store it originates from. Cards can be purchased in denominations from $10 – $500 at either the Town of Oro Valley’s Administrative Building or the Greater Oro Valley Chamber of Commerce. So if you’re looking for a gift card for a fellow Oro Valley resident, perhaps even for the holidays, this may be a great idea to keep the revenue local and provide the recipient with a large number of choices to spend the money. Use of the cards will most certainly help local Oro Valley businesses. This of course also means the Town earns the sales tax receipts rather than another municipality. Sales tax is a major source of revenue for the Town of Oro Valley, representing 47.5% of the general fund. For residents there is a direct connection between shopping locally and our quality of life. The fact is our infrastructure, public safety and parks are funded in large part through local sales generated by shoppers. Any money put onto an OV Dollars gift card are valid for one year. Participating Businesses As of September 12, 2013 This coming Saturday, October 5th, begins a new chapter for the Heirloom Oro Valley Farmers Market. Previously held at the Town of Oro Valley government buildings, the event will now be located at Steam Pump Ranch. This new location of Steam Pump Ranch is just north of the Home Depot on the west side of Oracle Rd. The physical address is 10901 N. Oracle Rd. Market hours from October through April are 9:00am – 1:00pm. The Farmers Market is a fantastic opportunity to purchase some local produce and also support our local farming community. More information on the Oro Valley Farmers Market can be found at: www.HeirloomFM.org or by calling (520) 882-2157. There is some MAJOR news taking effect that has largely passed under the radar in regards to flood insurance. Any owner of a home within a flood zone needs to be aware of these changes and any potential buyer of a similar property should be in tune as well. Effective this past Tuesday, October 1st, the federal government’s subsidy of the National Flood Insurance Program has ended. This change will lead to premiums rapidly rising in efforts to try and allow the program to become more self-sustaining. For example, FEMA quoted a new rate effective on October 1st for homes 4 feet below the agency’s base-flood elevation as $9,500 a year. Individuals with homes at FEMA’s base elevations would be looking at around $1,410 a year, while homes 3 feet above the base-flood elevation would pay only $427 a year. However, some high-risk areas could see premiums exceed $20,000 a year! This change is unrelated to the recent government shutdown but rather is a result of the National Flood Insurance Program’s deficit, which is reported at $28 billion. Congress passed the Biggert-Waters Flood Insurance Reform Act in 2012 in an effort to keep the program solvent for the long term. With storms such as Hurricane Sandy, Irene & Katrina, not to mention the recent Colorado flooding, the program has incurred huge losses. The Reform Act eliminates current subsidies for some 20 percent of policyholders in total, while others may not yet be affected. There are major efforts being made in Congress to delay or reform these changes, but especially with the government shutdown those efforts may not be successful. States with a huge number of affected homeowners like Florida & Louisiana are leading the charge but the economic realities of the risk these homes face may be too difficult to overcome. Most homeowners, particularly in Arizona, don’t have flood insurance and if desired it could become even more challenging to get and certainly more costly. This change will dramatically affect homeowners that are in flood areas where flood insurance is required and may in many cases make the homes unsustainable for their owners. Locally there are parts of Marana and Tucson that are notably in FEMA defined flood zones. Even some areas of Marana which successfully removed their flood designation may see future boundary changes which would again cause a major hardship. This could become a massive issue for certain communities and not only effects the current owners with higher premiums but will absolutely negatively impact their property’s value. Potential new buyers will be factoring in costs of flood insurance and will most certainly not pay as much for these homes as similar homes in other areas that don’t require flood insurance. If you are in a flood area (or nearby one which could see its boundaries change) or know someone who is please pass along the information and look into this issue further for more information. It’s been a very gentle roller coaster ride for interest rates over the last few months but rates have recently dropped again. Primarily impacting these rates recently was the decision by the Federal Reserve to continue its current rate of bond purchases which had the effect of rates sliding back down. However, at some point even without other factors involved, the Fed will taper their bond purchases and rates will rise. It’s only a matter of time and something that anyone looking to buy, or sell for that matter, should be fully aware of as they look into the future & make housing decisions. Here are the rates from last week’s Freddie Mac press release: Those buyers looking at government loan programs (FHA/VA/USDA) are in the neighborhood of 4.125% with no points for a 30-year FRM. Team Woodall’s affiliation with Long Realty means we have a tremendous amount of company resources at our disposal to help sell your property and you’ll be aligning yourself with the #1 brokerage in Tucson. Technology has become a crucial component of real estate today and Long Realty is at the forefront of the movement. Team Woodall further expands and customizes Long’s technology offerings to provide our seller clients the ultimate in technology & service. The above video is a great indicator of just some of the advantages that we can provide as your listing agent. Selling a home, especially in today’s constantly evolving market, requires successful marketing and correctly positioning your home to make it an appealing residence to a wide range of potential buyers. Partnering with Team Woodall for your property’s sale provides you with the requisite expertise & local real estate knowledge to effectively market your home and guarantees access to dedicated professionals working for your best interests.

Overall this is great news and while condo units still won’t be right for every buyer, they definitely have their advantages for a segment of folks. Team Woodall currently has one of these Vistoso Golf Casitas available for sale with another one coming on the market on October 1st. We’d be happy to assist with any questions you may have on condo financing or for even better assistance contact Steve Van De Beuken at Sunstreet Mortgage at (520) 547-4149. |

|||||

|

|

|||||