Unless you plan to pay for your new home with cash, speaking with a lender is critical for buyers at the very beginning of the process. Even if you’re considering a purchase but have some credit issues, speak to a lender immediately. They’ll provide excellent guidance on how to repair your credit most quickly, which debt to pay off first, and even the different types of loan programs available.

There are a multitude of mortgage programs available for a variety of buyers and types of purchases. There are still some programs that allow for 100% financing (notably VA and USDA loans), and FHA insured mortgages require a minimum of 3.5% down payment. Conventional loans begin at just 3-5% down and often have more favorable terms over the life of the loan than an FHA insured mortgage. Most investment properties will require a 20% down payment, and jumbo loans typically require between 10-20% down as well. Vacant land purchases that are financed usually need between 20-30% down at closing. A consultation with a mortgage professional is highly encouraged to explore all the options available to you.

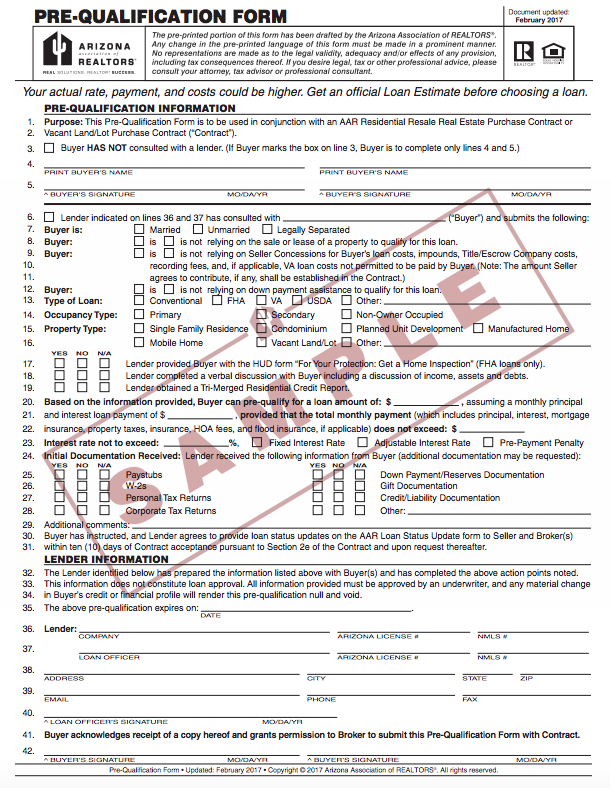

If you’re saving up for a down payment a lender will make sure you know all of the different down payment options available. Also, when submitting an offer the contract requires you have an Arizona Association of REALTORS Pre-qualification Form from a lender attached, so speaking with a loan officer before submitting offers is necessary. Below is the standard AAR Pre-Qualification Form:

We’ve worked with many lenders & loan officers over the years and continue to do so effectively. However, if you don’t have a lender in mind we highly recommend Trisha Azares with VIP Mortgage because of her excellent communication and ability to meet closing deadlines. VIP has competitive rates and fee structures, so start with Trisha and if you have any special financing circumstances we have other non-traditional lenders we can put you in contact with too.

Trisha Azares – VIP Mortgage Loan Officer

Office: (520) 696-8959

Email: TrishaA@vipmtginc.com

Regardless of which company you use, we do recommend it be a local lender who is familiar with our Arizona contracts and is available to meet your needs in person.

Next: Start your home search online

- Step 1: Find a REALTOR®

- Step 2: Get pre-approved for a mortgage (only applies to buyers who are not paying with cash)

- Step 3: Start your home search online

- Step 4: Time for showings

- Step 5: Make an offer

- Step 6: I have an accepted contract. Now what?

- Step 7: Schedule the home inspections

- Step 8: Drop off your earnest money check

- Step 9: Put the closing on your calendar

- Step 10: What is the inspection period?

- Step 11: Don’t spend extra money (only applies to buyers who are getting a loan)

- Step 12: Provide documents to your loan officer (only applies to buyers who are getting a loan)

- Step 13: Read the title commitment

- Step 14: Review the HOA documents (only applies to buyers who are purchasing homes with HOAs)

- Step 15: Fill out and return your buyer’s packet

- Step 16: Tips for attending the home inspection

- Step 17: Read the inspection reports

- Step 18: Make repair requests

- Step 19: The appraisal (only applies to buyers who are getting a loan)

- Step 20: Hire movers and start packing

- Step 21: Hook up your utilities

- Step 22: Set up homeowner’s insurance

- Step 23: Get your down payment ready

- Step 24: Secure your new home

- Step 25: Do you want a home warranty?

- Step 26: Make your down payment

- Step 27: Attend the walkthrough

- Step 28: Attend the signing

- Step 29: Get the keys

- Step 30: Wrapping things up?