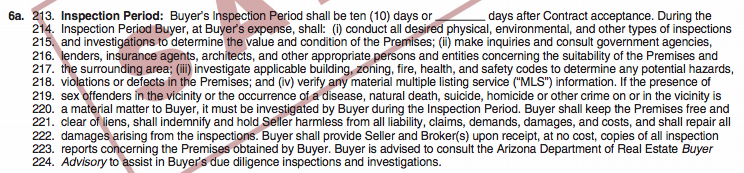

The Purchase Contract provides for a 10-day inspection period as a standard length, but we may have negotiated a longer inspection period which will be reflected on line 213 of your Purchase Contract. This is the time period in which you can cancel the contract due to something you discover about the property and still get a refund of your earnest money. At the end of the inspection period, we will present the BINSR (Buyer’s Inspection Notice and Seller’s Response) to the Seller, either accepting the property as is, cancelling the transaction, or requesting repairs be made.

Anything that matters to you is worth investigating during the inspection period. The Buyer Advisory (click here) is an excellent starting point to determine what you might want to check out. It’s also a reference to sources where you can find many answers. Some things many buyers want to look at are nearby properties that are vacant and their zoning, federal & local flood plains, whether any road construction or other building is planned in the near future, the presence of sex offenders in the area, and perhaps the crime statistics for the area. We recommend going by the property at varying times of the day and night to see how the home and neighborhood are at different times of the day. Talking to neighbors is always an option too. Ultimately the burden of investigation does fall upon you as the Buyer to check out anything that’s of interest to you! We’re more than happy to help when possible and can at least point you to places where you can find the answers to your questions.

If a vacant parcel is in the vicinity of the property you’re looking at we highly recommend doing as much research as necessary to find out what’s likely to be built there. Sometimes vacant parcels remain that way for a long time and sometimes things are already planned to be built and could be starting soon. Check on it with tools such as the Pima County GIS, talking to the town’s zoning/building division, and checking the internet/newspapers. Knowing the zoning is good, although it’s also possible for zoning changes to occur, so check as thoroughly as is necessary to find out the best information that’s available.

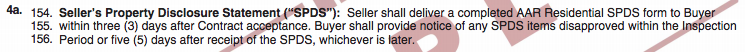

Seller’s Property Disclosure Statement

While this document is sometimes available prior to an offer, be sure to review it in great detail during the inspection period and make note of any questions. This is a disclosure document required to be filled out by the Seller and delivered to the Buyer within 3 days of contract acceptance. There are times when it’s not provided, usually in foreclosures, estate sales, corporate relocations, and sometimes investor flips. You’ll always receive at least a blank copy from us so you know the information you’re not getting from a Seller. While the Seller does have a legal obligation to disclose known, material facts about the property, some Sellers forget items, truly don’t know much about their own homes, or could potentially try to hide/downplay some things. Of course this is why we do independent inspections as well, but if there are any facts really important to you, it’s critical you run them down during the inspection period. Even with our long contracts and seemingly excessive legal jargon, you can still use the old adage, “buyer beware” as a good reminder that ultimately the impetus falls upon you to investigate anything you deem important.

We will need you to initial and sign the SPDS, acknowledging receipt and review of the information. If the information in the SPDS is old (from a listing being on the market a long time or some issues arising since it was filled out) there is a spot for a Seller to update info & initial it’s been updated. The SPDS is now required to be provided within the first three (3) days of contract acceptance, so the review & potential for disapproval/cancellation usually falls within the inspection period.

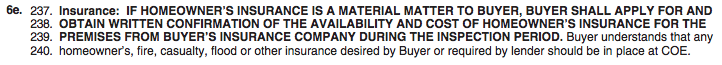

Homeowner’s Insurance

If the purchase is being financed you’ll be required by the lender to have and maintain adequate homeowner’s insurance. While homeowner’s insurance isn’t required if paying in cash, it’s obviously still highly recommended. You can check with your existing insurance carrier as you might get a discount for bundling or another option is getting a quote from Long Insurance.

You will need to call/email to get homeowner’s insurance set up. It’s best to do that during the inspection period in case there are any problems or you find the rates extremely high on the property for some reason.

Next: Don’t spend extra money

- Step 1: Find a REALTOR®

- Step 2: Get pre-approved for a mortgage (only applies to buyers who are not paying with cash)

- Step 3: Start your home search online

- Step 4: Time for showings

- Step 5: Make an offer

- Step 6: I have an accepted contract. Now what?

- Step 7: Schedule the home inspections

- Step 8: Drop off your earnest money check

- Step 9: Put the closing on your calendar

- Step 10: What is the inspection period?

- Step 11: Don’t spend extra money (only applies to buyers who are getting a loan)

- Step 12: Provide documents to your loan officer (only applies to buyers who are getting a loan)

- Step 13: Read the title commitment

- Step 14: Review the HOA documents (only applies to buyers who are purchasing homes with HOAs)

- Step 15: Fill out and return your buyer’s packet

- Step 16: Tips for attending the home inspection

- Step 17: Read the inspection reports

- Step 18: Make repair requests

- Step 19: The appraisal (only applies to buyers who are getting a loan)

- Step 20: Hire movers and start packing

- Step 21: Hook up your utilities

- Step 22: Set up homeowner’s insurance

- Step 23: Get your down payment ready

- Step 24: Secure your new home

- Step 25: Do you want a home warranty?

- Step 26: Make your down payment

- Step 27: Attend the walkthrough

- Step 28: Attend the signing

- Step 29: Get the keys

- Step 30: Wrapping things up